It's always a good idea to start compiling your financial records if you're applying for a mortgage. That is why it is critical to understand what information you must submit to your broker or agent, as well as the differences between some of these commonly requested documents. When working on your mortgage application, lenders will ask for proof of income, debt, and other important papers.

When applying for a mortgage, the following tax documents are often requested:

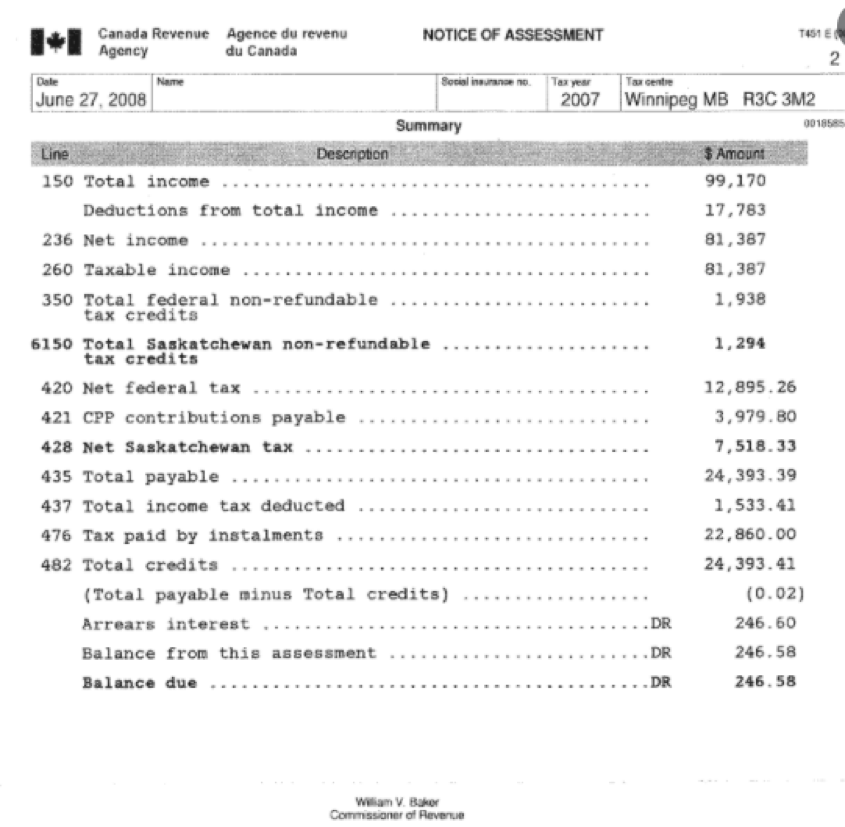

Notice of Assessment (NOA)

In the mortgage industry, NOA is a commonly requested document. CRA will send you a copy of your Notice of Assessment (NOA) after you have filed your taxes. This document validates a number of items, including the amount of income declared, the amount of tax you paid in the previous year, and whether or not you owe a balance. If your return was revised after it was originally submitted, this document may appear as a Notice of Reassessment. Mortgage lenders accept either a Notice of Assessment or a Notice of Reassessment.

You can acquire your Notice of Assessment in one of two ways:

● By mail - The Canada Revenue Agency sends it to you at the address you provided on your tax return.

● By CRA Website - The Canada Revenue Agency informs you that your assessment is accessible through My Account. Under the 'tax returns' page, you'll find your NOA.

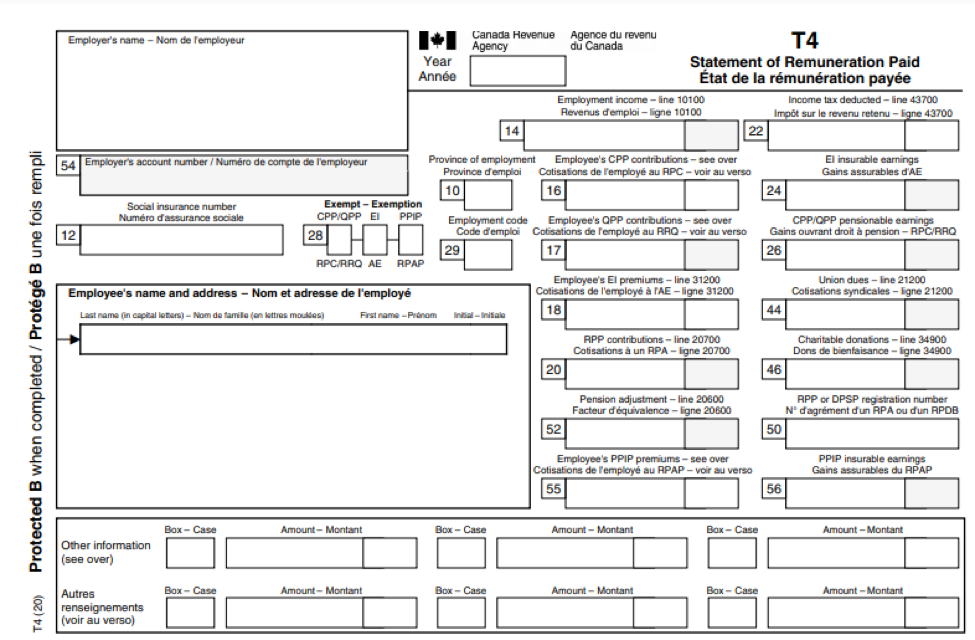

T4

A T4 slip is a year-end summary of your earnings and deductions from work. Your employer will give you a T4 form that shows how much you earned in the calendar year and how much income tax was deducted. This document will be provided to you by your employer by the end of February for the preceding tax year. You can also see your T4 slips by entering into CRA's website and going to 'My Account.'

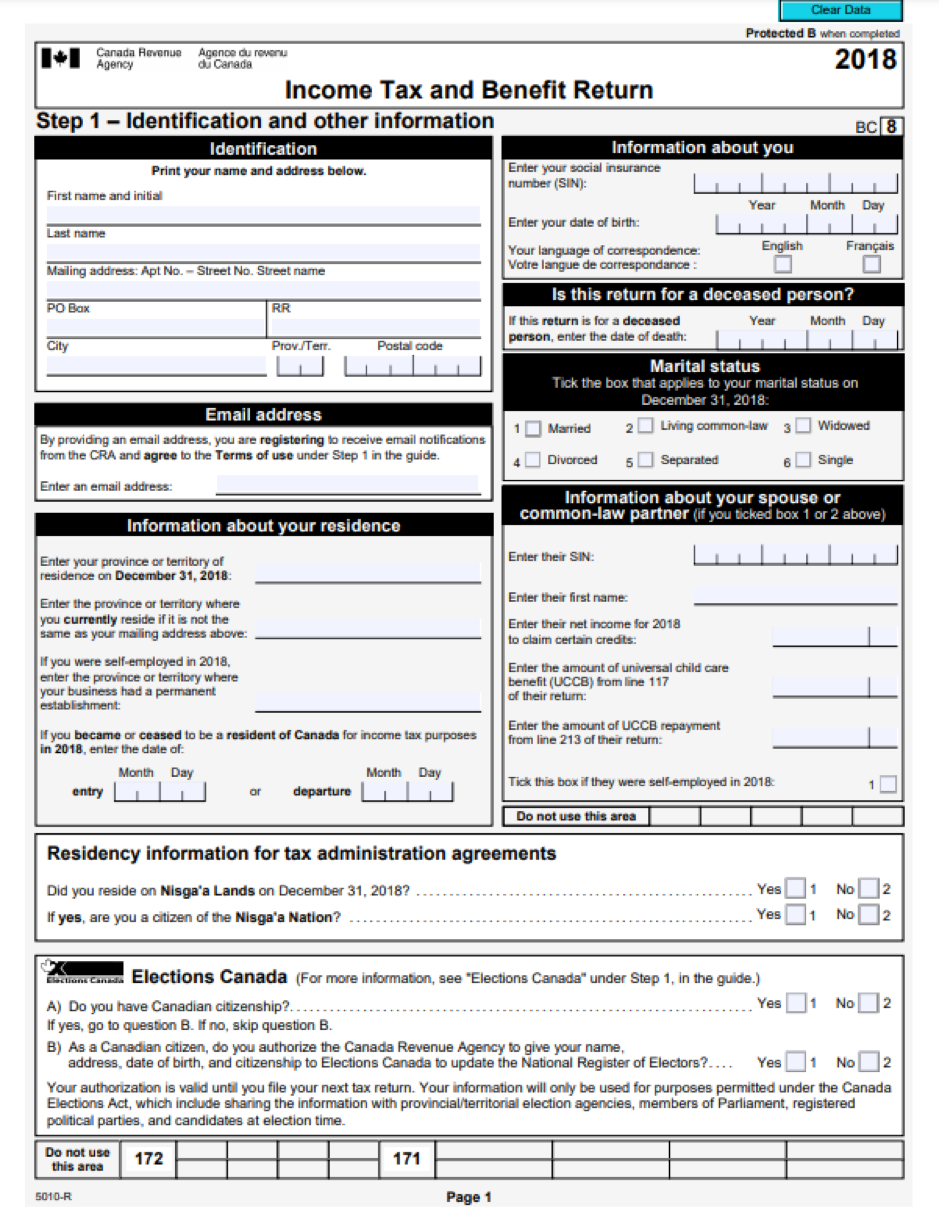

T1 General

The T1 General is basically your tax return, which you or your tax preparer must send to the Canada Revenue Agency (CRA) for processing. Your tax preparer will include a copy of your T1 Generals in the tax package you receive. You will obtain a copy of your T1 Generals in your tax software if you prepare and file your taxes yourself. If you can't find your T1 Generals, call your tax preparer, and they'll send you a copy.

To avoid delays, make sure you send all pages of your paperwork to your broker or agent when they want them. If you're unsure about the documents you'll need for your mortgage application, ask your mortgage broker.

Need extra hands? Get in touch with Property Finance Corp today and we’ll make sure you’ll get everything you need when applying for a mortgage in Canada.

Check Out Some Great Ways We Can Help You!

The Right Broker = The Right Mortgage Solution

Choosing the right mortgage solution is key to setting yourself up to achieve your goals and creating a bright financial future for you and your family. Choosing the right mortgage broker to help you get it is just as important. Property Finance Corp. is a team of dedicated and experienced brokers who can guide you through the often complex world of mortgage products. Leverage our skill, our industry knowledge, and our carefully cultivated lender relationships to find the mortgage solution that is most ideal for you.

Call us at 1-844-PF1CORP (731-2677) today.

Your Guide To A Strong Financial Future

You don’t have to travel the pathways to homeownership, mortgage renewal, refinancing, or accessing the equity in your home alone. Property Finance Corp. is uniquely positioned to guide you with insight and practical advice to ensure that the mortgage product you choose is exactly right for you.

Call us today at 1-844-PF1CORP (731-2677)

Disclaimer: By submitting the Contact Us form on our website, you acknowledge and agree that an SMS may be sent to the phone number you provided. The SMS will only be used to respond to your inquiry or to provide you with important updates and information related to our services. You may opt out of receiving SMS messages at any time by replying "stop" to the message. Standard messaging and data rates may apply. Use is subject to terms.